We get so excited and overwhelmed when we buy a new house, especially if we are first-time buyers, that we completely forget to buy home-owners insurance or give proper consideration to the home-owners insurance policies. One should always have an optimistic approach and assume that nothing wrong is going to happen, but what it any unforeseen situation happens and damages our house that is built by joining every penny of our hard-earned money. Instead of sulking and feeling helpless, then, we can simply be well prepared for any such situation by buying the right homeowners insurance. Though the area we live in might be free from any climatic hazards or hasn’t experienced any of the natural disasters like flood, earthquake, etc. in the recent years, still it can experience water damage or fire damage anytime even due to a minor accident. So instead of suffering losses or regret on our decisions later, we must buy homeowners insurance as soon as possible. Homeowners insurance has the capability to make you and your house all over again.

Monopoly is rare in our country, so in the field of homeowners insurance also, there is very high competition. Don’t get worried; we have some tips for you, that will help you in choosing the best homeowners insurance.

1. Get the market details

We must at least contact three companies to compare their services and coverage. Sometimes, the mortgage lender or home loan provider makes it mandatory for us to buy homeowners insurance, so that their risk is reduced. Due to the limited coverage provided by some of the providers, we have to purchase supplementary insurances-like flood insurance, earthquake insurance, etc. It is not mandatory that you buy your policy from any particular provider. Instead you must make a detailed comparison of the price, customer reviews, coverage policies of all the insurance service providers in your area, before making the deal. Since we need them the most during emergencies, make sure that they have excellent communication and customer service policies.

2. Be aware of the payment details

Most of the homeowners, tack their monthly insurance payments onto their mortgage check. The moneylender or the home-loan provider pays your insurance premiums, property taxes, etc. from your escrow account. Lenders allow this so that by paying the insurance premium, they can make their investment secure. After this, you have to take care of your insurance premium on your own, so you must be prompt in paying your installments so that there is no intrusion later.

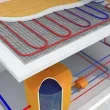

3.Coverage domain

Ensure that you are receiving adequate coverage from the company. The primary feature of the insurance policy is the amount of coverage they are providing. Avoid making any over purchase by including un-necessary coverages, but include all the possible causes from your end.

4. Understand the terms used in insurance policies

There are specific terms that we are not familiar with, first, go through each and every term and then only crack the deal.

Premium – This is the price that you have to pay for availing the insurance services, usually paid annually or monthly.

Liability Coverage – This is coverage that will pay the medical or legal expenses in case someone is injured on your property, generally due to negligence.

Personal Property – The private, tangible articles owned by you like furniture, flower pots, etc.

Make sure that you have understood all the terms and conditions of the policy distinctly, cross-check with the counsellor to avoid any existing ambiguity. Do not hesitate in asking any question to the service providers, always remember that you are investing your hard-earned money!